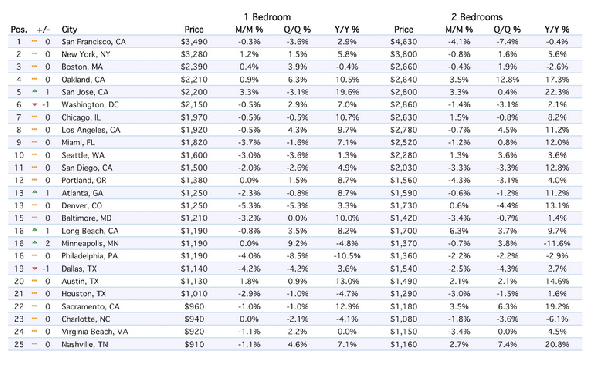

When Zumper.com released its yearly rentals report earlier this year it became crystal clear that Chicago has officially caught up with and, in some cases, exceeded the median rental cost of most metropolitan cities in the USA. Long gone are the days of affordable rent in one of the nations largest and most happening cities. We think last year came as the initial shock when Chicago broke the top ten in median prices for one bedroom rentals at a cost of $1,780 a month. In just 12 months that number has increased by a staggering 10.7% to $1,970 a month. Believe it or not, but Chicago is now the 7th most expensive rental market in the country, even exceeding San Diego and Los Angeles!

Those looking to stay renters are now forced to broaden their search to some of the more fringe neighborhoods. Neighborhoods to the north and west are becoming hot neighborhoods for renters, but even those looking to get a little more bang for their buck are stretching further than places like Humboldt Park, Logan Square and Uptown. In fact Lincoln Square, Roger Park and Jefferson Park saw the largest increases in median price from last year at 3.5%, 5.8%, and 4.9%, respectively. Not so surprisingly, this is actually causing neighborhoods like Lincoln Park and Lakeview to see decreases in rent year-over-year, but don't let that fool you as they still remain two of the most expensive neighborhoods to rent in.

Are there any other options?

The other option for Chicago renters is to jump into the buyers market. That may seem a little daunting for some, but in actuality buying is a much easier process than one may assume. Right now buyers can get approved for a loan for as little as 5% down and the mortgage rates are still at a historical low. To make this point a little clearer we did some rough calculations with Trulia.com's 'Rent vs. Buy Calculator' and what we found was quite interesting.

For this study, we used Lincoln Park as our subject neighborhood. When we took the median rental price of $2300 a month and compared it to a purchase at the median level of $430,000 we found that over a 10 year period you would be saving over $500 a month. That is a savings of $6000 a year or 23% less a month in living expense. Very interesting indeed...

Is there any relief in sight?

As more people decide to buy we would hope to see stabilization in the market, but with more and more Millennials joining the work force year after year it's tough to say whether or not that is true. The one silver lining is the massive amount of development happening in the downtown metro area of the city. Since the real estate market crash in 2008, many developers downtown have had a philosophical shift in what they are building. Choosing to build larger rental buildings as opposed to luxury condos is becoming more common. With an expected 8,000 new units being delivered by the end of 2017, many experts believe that that much inventory might just be what is needed to cool the current market. Only time will tell.

Owned and Operated by NRT, LLC.

Owned and Operated by NRT, LLC.

Stay Connected